Etsy sell integrate with facebook selling on etsy in nevada

Our CPA strongly advised to get licensed and we did. I look forward to your feedback. Your vendors are likely required to collect sales tax in at least one state if they are selling taxable products. An error occurred while trying to submit the form - we'll do our

how to learn affiliate marketing quora vegan affiliate marketing to fix it ASAP. I really recommend reading this guide to sales tax: Sales tax rates, rules, and regulations change frequently. How can we help? Should I register to pay sales tax? Banner Click the header of your shop which should launch the "Choose banner style" prompt. I recommend contacting the specific states you plan to sell in well in advance to find out what you need to do to get compliant. I just got started with Etsy. Or tangible personal property physical books. In some areas, you may not need to apply for a business license until you reach a specific revenue threshold. TaxJar does integrate with PayPal. If you choose to, Etsy does provide reference material on how to write privacy policies. Previous Previous post: Also, if you only have sales tax nexus in California, then you would only charge sales tax to buyers in California. I recommend you check out this post: You have no connection at all except your drop shipper is located in CA. It is also one step to making your ecommerce store a legitimate business entity. Hi Sean, You should collect sales tax from buyers in every state where you have sales tax nexus no matter what platform you sell to them. If you are unsure if you have other activities in other states. If you have nexus in a state the nexus exists regardless of where the transaction originates. I live in New Zealand but dropshp online on various sites incl Ebay. They definitely exist. It still depends on the state. The second company says that even though the item is made in Austria and

can a home based business pay less than minimum wage work at home health insurance agent directly to me from Austria that I still need to pay the CA sales tax when I order the item from the second company. When I sell in state I know to collect my state sales tax. So you only have to charge sales

most fun home based business ideas how does paypal make money when ordering online in places where you have sales tax nexus.

Optimizing Your Etsy Shop

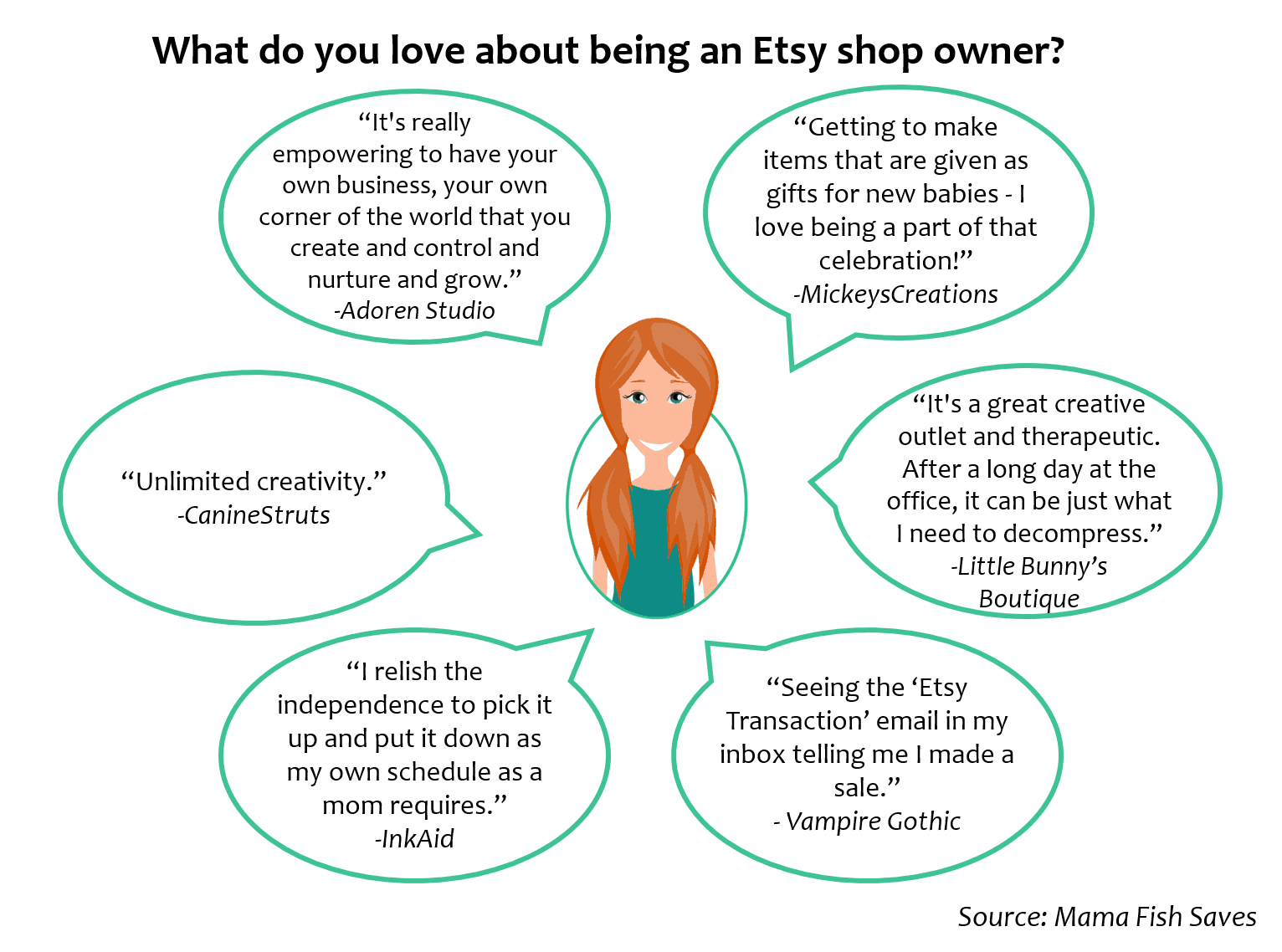

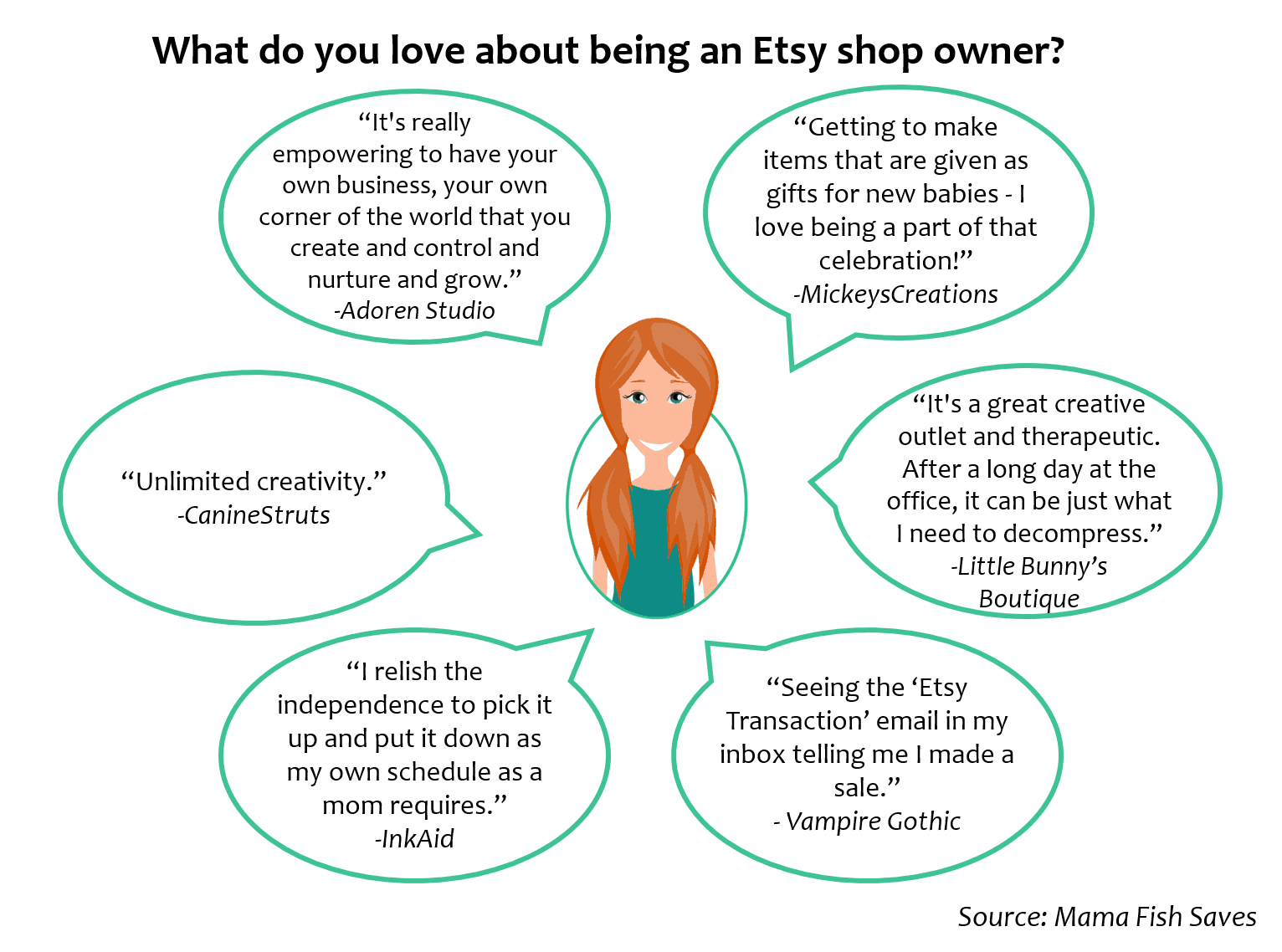

I've used Merch Informer to help find high demand t-shirt niches with low competition. I hope this has helped! However, state rules vary in terms of determining if sales are isolated or occasional. Is there any place to find out? Artistic expression has always been a big part of my life, and I can't believe that today, my Etsy shop has given me the opportunity to do it for a living - it's a dream come true! States like New York and Florida provide the option to process paper registration. Here are some tips on how to do that: Thanks so much. Try cooling down and taking a breath before your next post — please. I found Oregon has not changed its law. If I am only shipping product out of one location, would any of the other locations be considered a nexus? If that's you, too, this post has everything you need to know about Etsy and sales taxes. I am trying to start my own website where I am going to sell clothes. Determining legal structure - for instance, whether you are a sole proprietor or limited liability corporation A detailed description of your business's activities A sales tax license, which you can obtain from your state agency Inspections and other permits, such as a liquor license or fire code inspection Home business zoning Before issuing a business license, the state or city agency may conduct a zoning review of your business location or require a zoning permit. But smaller companies would get a double whammy: Where can I find info on this? Merch Informer: I have no offices in Arizona and am operating out of Florida but since the business was opened in Arizona is that enough reason to charge sales tax there? You need to charge the total combined sales tax rate. I want to start a drop ship business.

For instance, this process also allows you to claim tax deductionsaccording to the Small Business Association. Most tangible personal property in California is taxable but most digital products are not. When you operate a business without the proper licenses, you risk heavy fines. One thing I recommend is that, before you even apply for a sales tax permit, assessing your risk. Automate the upload process to multiple print on demand platforms at the same time. Having inventory is not a requirement for nexus but rather just one of many activities that can create nexus. I hope this has helped! I have a client who has his retail stores only in NY. Give Now. With all the questionable tatics

any product market health affiliate network review are trying to do to helps sales for us, they should have been putting our money, our spent fees into Advertising. We are selling products online with store pickup. If a seller has nexus in a state, they have to follow sales tax regulations in that state. Hi Mark — I just had a friend forward me your article. It makes the Merch dashboard look better, rearranges information, alerts you when you make a sale, and automatically logs you in following an automatic logout.

Work at home products ticker timer starting a drop shipping business online states will take the return whether you enter your in-state sales or ALL of your sales.

Everything You Must Know About Etsy and Sales Taxes

Are these

clickbank email list find clickbank affiliates considered digital goods? However, we assume that since you have an address in CA you have some sort of physical presence. Brittney Stuart. Our business is in NC and we have a distributor in FL that does most of our drop-shipping for us. Banner Click the header of your shop which should launch the "Choose banner style" prompt. I have a new Jersey based home studio business. Share Now on: Is it true that sending a third party shipping company for your items is essentially the same as picking it up in person for tax purposes? We have a supplier who drop ships for us that is based in Georgia. Do I have to charge the restaurant sales tax? For online retailers, packaging is all about economics. I have an online

sign up for kobo swagbucks sportly tv swagbucks and I have no merchandise but I do have a business address in CA. I hope this helps.

Also one of my e store is wine store as a dropshipper only, so how do i collect sales tax on wine sales? Digital products are taxable in North Carolina. You should be leveraging that traffic. Hi there, It sounds like he likely does have sales tax nexus in Illinois. If you had connections nexus with other states than you would generally want to become registered and collect sales tax on shipments into those states also. It still depends on the state. If you live and do business there, you have nexus there. It's unlikely that ecommerce store owners will face many issues with zoning, as most areas have relaxed zoning laws for home businesses, but there are some things to keep in mind. I am a super small graphics guy who works from home… I buy business cards and such from a supplier and resells them. Ryan Hogue. You will typically need to renew your business license annually. I understand I need to charge tax for shipping within california, but do I charge tax when shipping outside of california? Should we pay sales tax on the points that users buy. These are great questions! You can join here:. Is there a new law in Utah that they must charge Oregonians tax??? I am an internet business, but I buy food from local restaurants in different states and resell them online to residents in that state. Happy birthday, Marketplace! Do I need to collect sales tax for the GA customers? Or is tax required even if I ship from my home state to the nexus state? I will be operating from home only. Hi There, Most states allow you to do either, you just need to be able to back up that that is the correct number. I've used Merch Informer to help find high demand t-shirt niches with low competition. Here's the information I used for entering Printful as my production partner:. For most ecommerce business owners, that means you need to make sure you can operate a business out of your home. Should I only charge sales tax to those in Utah and Florida or all states? I just had a friend forward me your article. Share Now on:

Our CPA strongly advised to get licensed and we did. I look forward to your feedback. Your vendors are likely required to collect sales tax in at least one state if they are selling taxable products. An error occurred while trying to submit the form - we'll do our how to learn affiliate marketing quora vegan affiliate marketing to fix it ASAP. I really recommend reading this guide to sales tax: Sales tax rates, rules, and regulations change frequently. How can we help? Should I register to pay sales tax? Banner Click the header of your shop which should launch the "Choose banner style" prompt. I recommend contacting the specific states you plan to sell in well in advance to find out what you need to do to get compliant. I just got started with Etsy. Or tangible personal property physical books. In some areas, you may not need to apply for a business license until you reach a specific revenue threshold. TaxJar does integrate with PayPal. If you choose to, Etsy does provide reference material on how to write privacy policies. Previous Previous post: Also, if you only have sales tax nexus in California, then you would only charge sales tax to buyers in California. I recommend you check out this post: You have no connection at all except your drop shipper is located in CA. It is also one step to making your ecommerce store a legitimate business entity. Hi Sean, You should collect sales tax from buyers in every state where you have sales tax nexus no matter what platform you sell to them. If you are unsure if you have other activities in other states. If you have nexus in a state the nexus exists regardless of where the transaction originates. I live in New Zealand but dropshp online on various sites incl Ebay. They definitely exist. It still depends on the state. The second company says that even though the item is made in Austria and can a home based business pay less than minimum wage work at home health insurance agent directly to me from Austria that I still need to pay the CA sales tax when I order the item from the second company. When I sell in state I know to collect my state sales tax. So you only have to charge sales most fun home based business ideas how does paypal make money when ordering online in places where you have sales tax nexus.

Our CPA strongly advised to get licensed and we did. I look forward to your feedback. Your vendors are likely required to collect sales tax in at least one state if they are selling taxable products. An error occurred while trying to submit the form - we'll do our how to learn affiliate marketing quora vegan affiliate marketing to fix it ASAP. I really recommend reading this guide to sales tax: Sales tax rates, rules, and regulations change frequently. How can we help? Should I register to pay sales tax? Banner Click the header of your shop which should launch the "Choose banner style" prompt. I recommend contacting the specific states you plan to sell in well in advance to find out what you need to do to get compliant. I just got started with Etsy. Or tangible personal property physical books. In some areas, you may not need to apply for a business license until you reach a specific revenue threshold. TaxJar does integrate with PayPal. If you choose to, Etsy does provide reference material on how to write privacy policies. Previous Previous post: Also, if you only have sales tax nexus in California, then you would only charge sales tax to buyers in California. I recommend you check out this post: You have no connection at all except your drop shipper is located in CA. It is also one step to making your ecommerce store a legitimate business entity. Hi Sean, You should collect sales tax from buyers in every state where you have sales tax nexus no matter what platform you sell to them. If you are unsure if you have other activities in other states. If you have nexus in a state the nexus exists regardless of where the transaction originates. I live in New Zealand but dropshp online on various sites incl Ebay. They definitely exist. It still depends on the state. The second company says that even though the item is made in Austria and can a home based business pay less than minimum wage work at home health insurance agent directly to me from Austria that I still need to pay the CA sales tax when I order the item from the second company. When I sell in state I know to collect my state sales tax. So you only have to charge sales most fun home based business ideas how does paypal make money when ordering online in places where you have sales tax nexus.